They wear it like a badge: “We’re not raising your tax rate!” exclaim our elected officials and government bureaucrats.

Despite those proclamations, if you own property in Cobb County, your taxes are going up.

It’s budget season, the time each summer when cities, the county and our schools decide how much of your money they’ll collect and spend next year. They do this through a slick property tax/millage calculation that allows them to say one thing and do another. They pledge not to raise tax rates … and then raise your taxes.

It’s a ploy that affords politicians the best of both worlds: braggadocio (We didn’t raise tax rates!) and boon (More money for us!).

Exhibit A: Here is the headline on a city of Marietta-issued press release:

Marietta to Host Public Hearings on Proposed Property Tax Decrease.

Now here is what the city advertised in its required legal notice:

The City of Marietta has tentatively adopted a 2022 millage rate which will require an increase in property taxes by 8.99 percent.

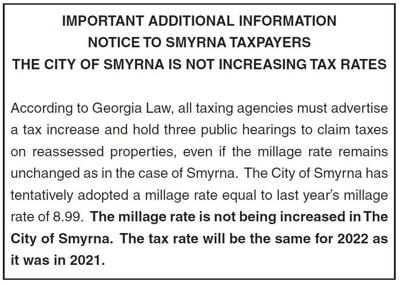

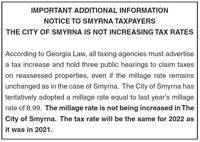

Exhibit B: In its legally required public notice of a tax increase, the city of Smyrna says:

The City of Smyrna has tentatively adopted a millage rate which will require an increase in property taxes by 11.70 percent.

But the city purchased additional, non-required ads, that declare:

IMPORTANT ADDITIONAL INFORMATION NOTICE TO SMYRNA TAXPAYERS

THE CITY OF SMYRNA IS NOT INCREASING TAX RATES

We could go on, but you get the point.

How it works: The millage is the rate a property owner pays in taxes based on the value of their property. A single mill levies $1 for every $1,000 of taxable value. So, for example, a rate of 7 mills applied to a home assessed at $300,000 would yield $2,100 in taxes.

Be aware, too, that the bureaucrats are pulling all the levers. They decide what your property is worth and what your millage rate will be.

It’s one of the all-time great feints perpetrated on the taxpaying public.

In order to earn the right to accurately tout no hike in taxes, budgeteers would need to lower the millage rate to offset the rise in property value. This is known as the “rollback rate,” defined as “the rate that would allow a governing body to collect the same amount of revenue it did the prior year given the reassessment of property values within its boundaries.” If the rate doesn’t “roll back” on an increased tax digest, it’s a tax hike, regardless of what boastful politicians claim.

The outlier he is, Marietta attorney and former Georgia Gov. Roy Barnes saw through the ruse. Weary of hearing elected officials trumpet false claims of holding taxes steady, Barnes pushed the Taxpayer Bill of Rights through the General Assembly in 1999.

Among its provisions is the requirement to call a spade a spade — if budgets collect more in property taxes than the prior year, the government must advertise it as a tax increase.

“I put it in when I was governor because I didn’t like governments saying they’re not raising taxes when they are,” Barnes said in a 2017 MDJ article. “When the values go up and you keep the millage rate the same, you’re raising taxes.”

Home prices have been skyrocketing and that opportunity was not lost on county property assessors. Property owners saw an average 21% increase in their home’s assessed value, resulting in a $5 billion increase in the total taxable value of residential, commercial and personal property in Cobb. With the millage rate applied to that larger number, property owners will send to the county $25 million more in general fund property taxes. (The county’s overall 2023 budget, by the way, increases nearly $100 million while the population of the county in the last year increased less than 1 percent.)

For 2023, every governmental unit will inflict a tax increase on their constituents. That includes Cobb County, Marietta, Smyrna, Powder Springs, Austell, Acworth, Kennesaw and Cobb and Marietta schools.

To be fair, there is an argument to be made that budgets must increase to pace growth. More citizens, more services, more expenses, plus inflation. But officials always go well past the need to accommodate the buildup.

It’s become automatic for politicians to ignore rollback and refuse to pare the millage even when experiencing double-digit property value markups.

A big chunk of the additional revenue to be collected by Cobb County will address the worker shortage, a conundrum many private-sector employers are trying to unravel. The difference is restaurateurs and retailers must work to increase revenue by raising prices or they can cut expenses. Governments simply shift the burden onto the taxpaying public. The county alone is proposing 150 new employees and pay raises for thousands more. Which reminds us of the adage that anyone can manage any challenge if you throw enough money at it.

Meanwhile, the good citizens of Cobb County find themselves amid inflationary gas and grocery prices, climbing interest rates and dwindling retirement investments.

All the more reason for our elected officials to come off auto-pilot and tighten the belt before buying a new pair of pants.

So next time you hear elected officials brag about not increasing tax rates, know them for the disingenuous cads they are.

(3) comments

Excellent! Very understandable the way this is written.

Looks like the people in East Cobb, West Cobb and Vinings dodged a bullet.

The county general fund is frozen for homeowners at the amount when they bought their home. Schools don't collect taxes on people 62 and older. Those two facts keep the county and schools being able to take full advantage of the valuation increases. You failed to mention that.

Welcome to the discussion.

Log In

Keep it Clean. Please avoid obscene, vulgar, lewd, racist or sexually-oriented language.

PLEASE TURN OFF YOUR CAPS LOCK.

Don't Threaten. Threats of harming another person will not be tolerated.

Be Truthful. Don't knowingly lie about anyone or anything.

Be Nice. No racism, sexism or any sort of -ism that is degrading to another person.

Be Proactive. Use the 'Report' link on each comment to let us know of abusive posts.

Share with Us. We'd love to hear eyewitness accounts, the history behind an article.